‘Strange’ is the word one longtime state budget official uses to describe the situation this year.

While revenues are currently higher than anticipated, the administration and legislature are focusing on a tight budget and possible cuts — but not quite at the level just after the great recession when agencies were tasked with cutting ten percent across state government.

“It’s not near that level, from my perspective," said Jim Terwilliger, the commissioner of the Bureau of Finance and Management — an executive branch agency that helps craft state budgets every year and carry out its fiscal plan.

Terwilliger worked for state government during that time. He says the state used federal stimulus dollars differently for the recession as opposed to the COVID-19 pandemic.

“We’re in a different situation now, where the federal money we didn’t use to plug any state budget gaps," Terwilliger said. "We used it, really, for one time infrastructure investments. The facts are different. We’re just facing a little softness in our revenue right now.”

The state and lawmakers look at two kinds of revenue — ongoing and one-time. Ongoing revenues are categories like sales tax and contractors excise tax collections. They are down by about $30 million.

The state’s budget wizards anticipate that to continue.

“Since the governor’s budget address, we’ve had two more months of revenue come in and really nothing that would make me a lot more optimistic about what our projection would be," said Rep. Tony Venhuizen, R-Sioux Falls.

That’s why Gov. Kristi Noem proposed cuts to some ongoing expenses — like to SDPB’s budget, the state library, building maintenance and others.

But, it’s a different kind of revenue that makes this year’s budget picture unique.

“It’s highly unusual to see this level of one-time money, compared to a lower amount of ongoing funds," said Nathan Sanderson with South Dakota Retailers.

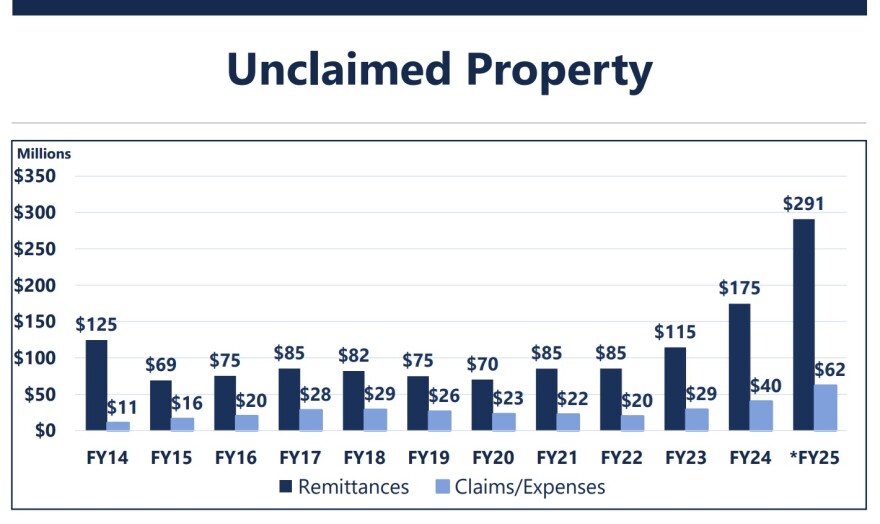

Most of those unusual dollars are what’s known as unclaimed property. This year, about $300 million came in.

Unclaimed property works like this: if a bank is unable to reach a customer about assets that have been inactive for three years, those assets get handed over to the state.

This year the state is seeing a lot of unclaimed property—three times as much.

Sanderson said he believe it’s lingering federal COVID stimulus dollars.

“If we think about it — we’re in 2025 now. Three years ago was 2022. I think we’re still seeing a lot of that COVID money in the unclaimed property sphere," Sanderson said. "It’s unlikely that we’re going to see that going forward.”

The current administration is looking to use a large amount of the one-time money to complete a massive project to replace the men’s prison near Sioux Falls.

But unclaimed property is technically a liability — it must be returned to its rightful owner.

The South Dakota State Treasurer oversees that effort.

“Even if the Legislature spends it, or we spend it on our budget, it is still claimable and is returned to somebody else when they come forward," said Treasurer Josh Haeder.

There’s currently $1.2 billion in unclaimed property sitting in state coffers. But it’s not drawing any interest.

Because the state is seeing such a large amount, Haeder said there’s an opportunity to generate a new line of revenue.

“What we’ve talked about is an unclaimed property trust fund," Haeder said. "And really, what that would say is all of the money that comes in—once we’ve made our best effort to return it—and we return those dollars... what is not returned goes into a trust fund that is managed by the South Dakota investment council.”

Haeder estimates a trust fund could generate anywhere from $40 million to $70 million annually.

It’s an idea that’s been floated as recently as 2018.

The idea may have more traction in a year where ongoing revenues are down. Lawmakers are looking for consistent money anywhere they can get it.